An increase in total assets of 35000. Issues 20000 shares of common stock for cash.

1000 Bit Computer S Description Vintage Ads Old Ads Serial Port

To run successful operations a business needs to purchase raw material and manage its stock optimally throughout its operational cycle.

. Increase Accounts Payable Question 11 of 20 50 50 Points If total assets are 30000 and total liabilities are 18000 Capital must equal _____. Purchased equipment for cash. Rahul started business with cash 100000 Jan.

Business Accounting QA Library Purchasing computer equipment for cash willa. Corporation pays 275 for an ad in the newspaper. 4 Placed an order for HP Printers for 15000 amount advanced 5000 Jan.

Increase both total assets and total liabilitiesb. Is there a debit or credit balance and what is the amount. A department purchases a desktop computer system for 4000.

The new corporation purchased new asset equipment for 5500 and paid cash. If for example the cash purchase of goods is for 1000 buy cheque. Debit your Computers account 10000 and credit your Cash account 10000.

Then the business made payments of 125 for a utility bill and paid 200 for business supplies on the same day. Up to 10 cash back Since you are using a double-entry accounting system you can see if all entries were recorded correctly. If a corporation purchases a delivery van for 35000 cash the net impact of this transaction will be a.

No impact on total assets. 0 9582 9500 82 177 19341. A decrease in total assets of 35000.

Lartex a new company completed these transactions. The CPU is expensed to 3189. Name two things that 1 increase Apple Computers stockholders equity and 2 decrease Apples.

All cor-porations have common stock. Lets say you buy 10000 worth of computers and pay in cash. As the supplies on hand are normally consumable within one year they are recorded as a current asset in the balance sheet of the business.

Alternate problem B The transactions listed below are those of Reliable Computer Repair Inc for April. We want to increase the asset Equipment and decrease the asset Cash since we paid cash. 3 Rent was paid for April 3500.

For example if a business purchases a computer for 5000 with 5000 of cash in its bank account the business would generally record the transaction by reducing its cash assets by 5000 while correspondingly increasing its equipment assets by 5000 resulting in a. The company reimbursed S. The business only revenues for the day came from two customers who came in for products.

Received customer payments of 965. The effect of this transaction on ASIs accounting equation is. If a corporation purchases a delivery van for 35000 cash the net impact of this transaction will be O A.

Purchases equipment on account for 3500 payment due within the month. Filed articles of incorporation with the state and issued 100000 shares of capital stock. 2 Chapter 40878 Page 56 092507 jhr STOP think.

Bill is received for electricity used 235. The company received 4633 cash from Liu Corporation for computer services performed. Apple Computer receives cash and issues common stock to its stockholders.

The following are several transactions from this businesss current month. The accounting equation shows that one asset increases and one asset decreases. Suppose a business had 5000 in its cash account.

Rey in cash for business automobile mileage allowance Rey logged 1000 miles at 032 per mile. On December 3 2021 ASI spends 5000 of cash to purchase computer equipment for use in the business. 3 Bought goods from Ms.

The itemized monitor mouse and keyboard are expensed to 3150. And credit the account you pay for the asset from. On December 3 2021 Accounting Software Co.

Cash of 100000 is received from the new owners for the shares. A business can make a cash purchase using either cash or cheque. When we analyze that transaction it would show that the accounting effects would be an increase in an asset account Computer Equipment and a decrease in another asset Cash since we paid for the equipment.

Have no effect on total assets total liabilities or stockholders equityd. How to Record the Cash Purchase of Goods. Check to see if the sum of the debits equals the sum of the credits.

7 Office equipment was purchased on account from Wagner Company for 76800. Services worth 850 performed 25 is paid in cash the rest will be billed. 4 Purchased furniture 2000 Jan.

Lets try to prepare the journal entry for this transaction. 1 Cash of 500000 was received for capital stock issued to the owners. 4 Purchased computer through cheque 13000.

Transactions C3C4 Corporation Transaction C3. Metro paid 5500 cash for equipment two computers. When a business purchases supplies for cash it needs to record these as supplies on hand.

4 Purchased calculator 1000 Jan. When you first purchase new equipment you need to debit the specific equipment ie asset account. The company purchased computer supplies for 1125 cash from Harris Office Products.

A decrease in total assets of 35000. In case of a journal entry for cash purchase Cash account and Purchase account are used. The customers each paid 250 cash.

Decrease both total assets and stockholders equityc. The payment to the supplier is immediate there is no credit given by the supplier for the goods. Accounting Equation for a Corporation.

On June 3 2021 our company purchased computer equipment for its main office and paid 120000 in cash. Has a cash balance of 7500 before the following transactions occur. An appraiser values the land at 20000 and the warehouse at 60000.

The effect of this transaction on the accounting equation is. A companys common stock is its most basic element of equity. Accounting and journal entry for credit purchase includes 2 accounts Creditor and Purchase.

An increase in total assets of 35000. An increase in both assets and liabilities of 35000. Spends 5000 of cash to purchase computer equipment for use in the business.

Decrease both total liabilities and stockholders equity. The accounting equation reflects that one asset increases and another asset decreases. 9759 9582 19341.

Supplies purchased on account 435. 6 Trucks were purchased for 56000 cash. Paid Cash for Supplies Journal Entry Example.

3 Paid cartage 300 Jan. Purchased a warehouse and land for 80000 in cash. Please notice that since Printing Plus is a corporation we are using the Common Stock account instead of Owners Equity.

3150-Computer Supplies and Servers This account includes computer and printer. 2 Paid into bank 60000 Jan.

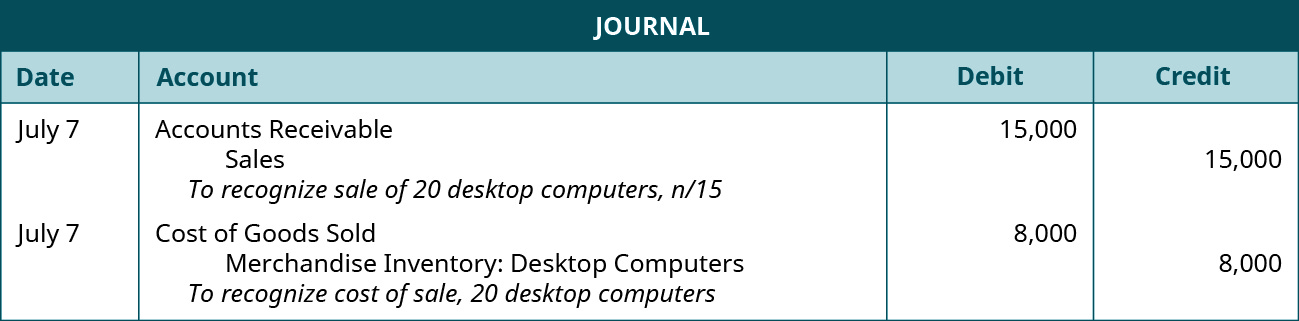

Analyze And Record Transactions For The Sale Of Merchandise Using The Perpetual Inventory System Principles Of Accounting Volume 1 Financial Accounting

Drawbacks To Avoid When Purchasing Your Pos Software Point Of Sale Pos Security Camera

Book Keeping Services For Small And Medium Scale Businesses Scale Business Bookkeeping Services Accounting Services

0 Comments